- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

Benetton Board approves the results for the 2003 financial year

Casual clothing turnover in line with previous year, net income 108 million euro. Net financial position for 2004 forecast in line with 2003

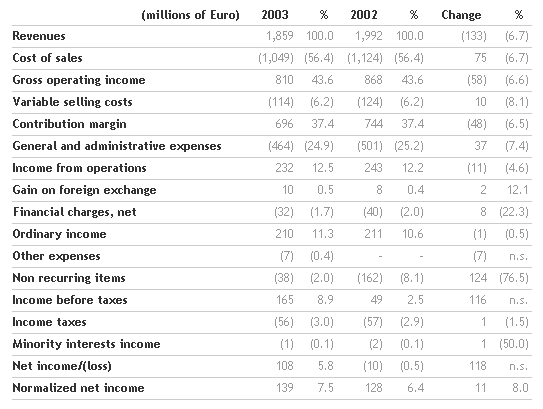

Ponzano, 30th March 2004. Consolidated revenues of 1,859 million euro, net income of 108 million euro, normalised net income of 139 million, self financing stable at approximately 330 million euro and net financial position improved at 468 million euro: these were the key numbers, approved today by the Board of Directors, with which the Benetton Group closed the 2003 financial year. Distribution of a dividend of 0.38 euro per share, payable from 27th May, equal to 69 million euro in total, will be proposed at the shareholders' meeting (convened for 12th May).

2003 consolidated revenues showed continued staying power in the clothing division and a large drop in the sports sector associated with the disposal of the sports equipment brands, which took place in the first half of the year. The value of consolidated revenues for 2003 was 1,859 million against 1,992 million recorded in the previous financial year. Revenues, net of the sports equipment disposal and currency impact, showed an increase of 1.2 %, a value which rose to 2.1 % for casual clothing.

The gross operating income was 810 million euro compared with 868 in 2002, with a ratio to sales unchanged at 43.6%. In addition to the impacts of the sports equipment disposal and foreign exchange, the gross operating income was positively influenced by the increase in volumes and the policy to improve product mix, which mainly concerned the casual clothing division.

Income from operations was 232 million euro compared with 243 for 2002 with an improved ratio to revenues, which moved to 12.5% from 12.2% due to the disposal of the sports business. The lower income from operations for the casual clothing division was attributed to exchange rate movements and higher accruals.

Normalised net income, before non-recurring items, was 139 million euro against a normalised value of 128 million in 2002. Net income for the financial year was 108 million euro (against a loss of 10 million euro for the previous year).

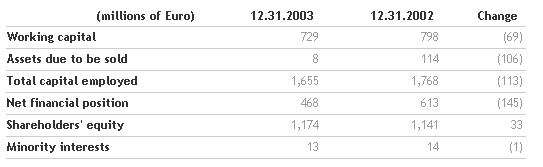

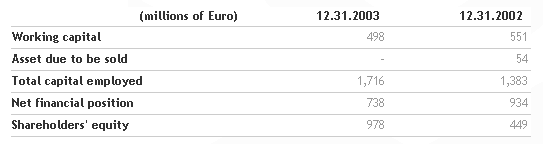

The equilibrium and strength of the Group balance sheet continue to be excellent, with the net financial position significantly improved at 468 million euro from 613 million euro at the end of 2002 and shareholders' equity (at 31st December 2003) of 1,174 million euro, making it possible to continue a strategy of special attention to shareholder remuneration, with a total dividend equal to 69 million euro. Additionally,working capital was reduced to 729 million euro, from 798 million at year-end 2002, due in particular to efficient control of commercial credit.

Self-financing in the year was virtually stable at approximately 330 million euro and was well able to meet net operating investments, which were 126 million euro in the year, directed in particular towards continued strengthening of the sales network and production. Free cash flow (before dividends and expenses relating to the disposal of the sports equipment brands) was 122 million euro (85 million to the end of 2002).

Finally, the Board analysed performance trends for 2004. Faced with cautious consumer spending, in particular in the clothing textile sector, and in line with forecasts presented in December in the Group 2004-2007 Guide-lines and with the communication following the Board of Directors meeting on 6th February 2004, gross operating and operating margins are expected to be substantially in line with 2003.Turnover, no longer including activity associated with sports equipment, should be around 1,800 million euro. Net income is expected to be around 7% of turnover. A moderate increase is forecast for casual clothing division revenues, with a target around 1,580 million euro.

Self financing for 2004 is forecast to be in line with that of the 2003 financial year, as is the net financial position, despite the tax payment linked to the company reorganization. Investments should be around 100 million euro, mostly focussing on development of the sales network.

Group Results

Consolidated income statement

Financial position

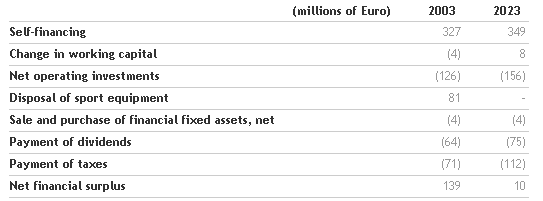

Summary statement of cash flows

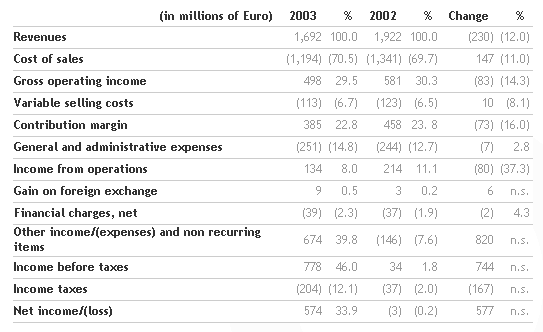

Benetton Group S.p.A. results

Statement of income

Financial situation

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi