- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

Benetton Board approves the results for the 2004 financial year

Consolidated revenues of 1,686 million euro, net income increases to 123 million euro Dividend of 0.34 euro per share. Alessandro Benetton proposed as second Vice-Chairman

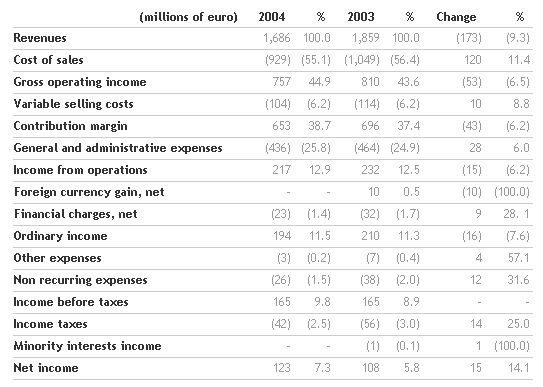

Ponzano, 31 March 2005. Consolidated revenues of 1,686 million euro (1,859 million in 2003), increased net income of 123 million euro (108 million in 2003), improved net financial position of 431 million euro (468 million in 2003): these were the principal results, approved by the Board of Directors today, with which the Benetton Group closed the 2004 financial year. At the Shareholders' Meeting (called for 16 May), distribution of a dividend of 0.34 euro per share will be proposed, payable from 26 May, equal to 62 million euro in total.

FINANCIAL RESULTS

Consolidated revenues for 2004 were 1,686 million euro, compared with 1,859 million euro in the previous financial year, influenced by the disposal of the sports equipment business completed in the first half of 2003 and by persistent unfavourable trends in the principal foreign currency exchange rates. Consolidated revenues, net of the impact of these two elements, were 1,674 million euro (against 1,740 million euro in 2003) with a reduction of 3.8%. Casual clothing sector revenues amounted to 1,504 million euro (1,579 in 2003) with constant volumes.

The gross operating margin was 757 million euro compared with 810 million in 2003, with a ratio to revenues of 44.9%, compared with 43.6% in the previous financial year, positively influenced by greater efficiency in production and logistics and by focussing on the core clothing business.

Income from operations was 217 million euro compared with 232 million in 2003, with an improved ratio to revenues that moved from 12.5% to 12.9%, due to significant industrial efficiency and careful attention to the control of general expenses.

Net income for the year was 123 million euro compared with 108 million euro in 2003, with a ratio to revenues amounting to 7.3% compared to the previous 5.8%.

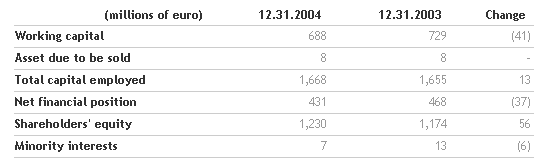

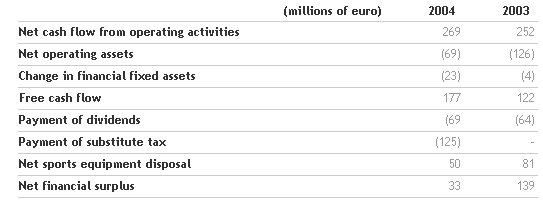

The stability and strength of the Group balance sheet is confirmed as of the highest order, with the net financial position down to 431 million euro from 468 million euro at the end of 2003 and shareholders' equity (at 31 December 2004) of 1,230 million euro, making it possible to maintain a strategy of special attention to stockholder remuneration, with a total dividend of 62 million euro, equivalent to around 50% of consolidated net income. Free cash flow, before dividends, cash flows relative to the sale of the sports equipment business and payment of substitute tax, improved to 177 million euro (122 million in 2003).

APPOINTMENTS

The Board also proposed a change in the articles to allow the appointment of a second Vice-Chairman within the Company Board of Directors, subject to approval by the Shareholders' Meeting. It has already been proposed that this office be entrusted to Alessandro Benetton, currently a director and member of the Benetton Group Executive Committee.

The Board then appointed, by co-optation, the new independent director, Professor Giorgio Brunetti, to replace the non-independent outgoing director, Sergio De Simoi. The new director will be a member of the Internal Audit Committee, substituting the outgoing director. Prof. Brunetti, a respected university professor, is a director of Messaggerie Italiane, Messaggerie Libri, Autogrill and Carraro, as well as an auditor of the Authority for Energy and Gas.

FINANCIAL DEBT

In view of the expiry of the 300 million euro bond (in July 2005, that places limitations on granting collateral security for new loans, but does not require observance of any financial ratio - financial covenants), which the company will finance for the most part from cash flow, the Board Meeting of 4 March 2005 authorised the management to negotiate, within the first half of the year, an agreement with the banks for a new revolving credit line, for a maximum amount of 500 million euro.

The syndicated loan, maturing in July 2007, provides for observance of two financial ratios, to be calculated half-yearly based on the consolidated financial statements, as follows:

It also places limitations on disposals of significant business activities and on granting any collateral security relating to new financing operations.

FUTURE OUTLOOK

In a scenario dominated by a weak economy and very cautious demand, the group has established an important policy of incentives to the network of sales partners, in line with the business model, to allow them to increase their investment capacity, to open new locations and to renew existing ones, as well as to increase their competitive capacity in terms of pricing to the final customer. This policy of incentives to the network has also been made possible by efficiency actions, optimisation of production and organisation systems and by strict containment of structural costs. Revenues for 2005 are expected between 1,620 and 1,650 million euro, with EBIT around 9.5-10% and net income around 6%. In 2005, the level of investments will amount to around 130-150 million euro, leading to a net financial position of around 400 million euro and free cash flow of around 100 million euro.

AUTHORISATION FOR THE PURCHASE AND SALE OF TREASURY SHARES

The Board has decided to ask the next Shareholders' Meeting, called for 16 May 2005 at first sitting, to approve the 2004 financial statements, to authorise the purchase and sale of treasury shares with the objective of providing temporary employment for liquidity generated by cash flows.

The proposal provides for the assignment of full powers to the Board of Directors, in compliance with the relevant provisions of the law and regulations, for the purchase of up to a maximum of 3,000,000 ordinary Benetton Group S.p.A. shares, which are part of the shares available in the market, valid for a period up to and not later than the date of approval of the 2005 financial statements and, in any case, not later than 30 June 2006. The purchases may be made in stock exchanges at a minimum price of not more than 30% under, or a maximum price of not more than 20% over, the reference price recorded by the share in the stock exchange session preceding each individual transaction.

The authorisation to sell, in total or in part and in one or more tranches, any shares purchased and others still in the Company's portfolio will be valid for a period up to and not later than the date of approval of the 2005 financial statements and, in any case, not later than 30 June 2006. Sales may be made In stock exchanges, at prices not less than 90% of the reference price recorded by the share in the stock exchange session preceding each individual transaction.

INTRODUCTION OF IAS/IFRS

In order to ensure a proper transition to the new IAS/IFRS international accounting principles, the Benetton Group initiated a project during 2004 to identify, diagnose and make changes in procedures, management, accounting and computer systems.

Benetton Group intends to adopt IAS/IFRS principles with effect from the consolidated half-year report to 30 June 2005.

Currently therefore, activities are being finalised for the quantification and revision of the consolidated income statement and balance sheet situation to 31 December 2004 and of 2004 interim reports prepared solely for comparative purposes.

The main adjustments to shareholders' equity at 1 January 2004, which have emerged to date, from the application of IAS/IFRS to the Benetton Group financial statements are:

Among further differences emerging from the application of IAS/IFRS to the Benetton Group financial statements but which do not have any impact on the reconciliation at 1 January 2004 are the following:

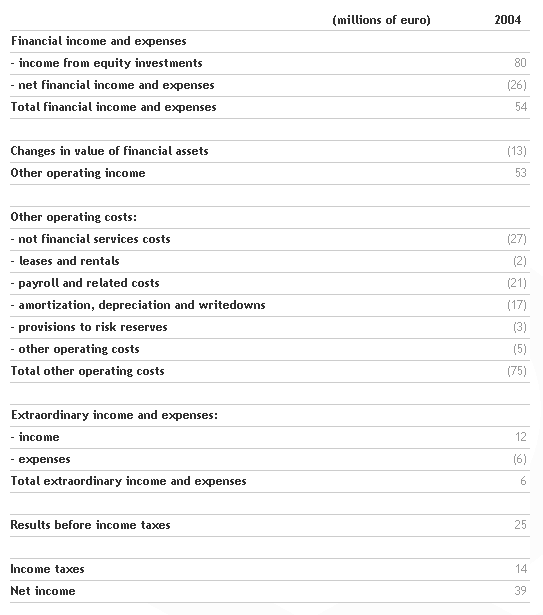

THE PARENT COMPANY, BENETTON GROUP S.P.A., FINANCIAL STATEMENTS

Benetton Group S.p.A., the parent company, closed the 2004 financial year with net income of 39.1 million euro (a result which cannot be compared with 2003 because of the company reorganisation in December 2003).

The Board has decided to propose a dividend of 0.34 euro per share (previous dividend 0.38 euro per share) at the Shareholders' Meeting, with coupon detachment date 23 May 2005. The dividend, for a total amount of about 62 million euro, consists of around 39 million euro from the 2004 financial year net income and around 23 million from the extraordinary reserve.

Group Results

Consolidated statement of income

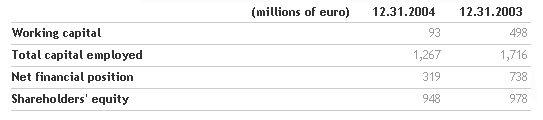

Financial situation highlights

Summary statement of cash flows

Benetton Group S.p.A. results

Statements of income reclassified

Data not comparable with 2003 because of the company reorganisation in December 2003

Financial situation

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi