- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

Benetton Group approves the 2007 first half results, consolidated net income 70 million euro, up 10.2%

Benetton Board of Directors resolves to file application to deregister and delist from NYSE

Ponzano September 12, 2007 - The Benetton Group Board of Directors, meeting today, approved the results for the first half of 2007 and resolved to file application to deregister and delist from the New York Stock Exchange.

Consolidated results for the first half of 2007

Group net revenues for the first half of 2007 were 990 million euro, up 92 million (+10.2%) compared with 898 million in the first half of 2006, driven by the apparel segment.

Worthy of particular mention are:

- the trend of revenues from the partner-managed network, positively influenced by good reception of collections in the market and commercial development initiatives;

- growth of sales by directly operated stores, also due to the contribution of the Italian partnership Milano Report, consolidated since August 2006.

The main growth factor was the strong acceleration in volumes (+13% compared with the same period of 2006) with a total of 74 million garments sold for the first half year. A positive contribution also from product mix, while negative impacts on revenues resulted from exchange differences (11 million euro) and the completion of policies to increase margins to the network with the 2007 Spring/Summer collection.

Gross operating income as a percentage of revenues was 42.7%, compared with 42.3% in the first half of 2006, going from 380 million euro to 423 million euro, favourably influenced, in particular, by managerial efficiency, volume and mix, as well as, partially, by weakness of the dollar.

The contribution margin was 355 million euro, compared with 315 million in the first half of 2006, and 35.9% of revenues compared with 35.1%.

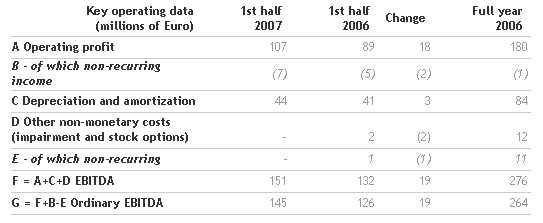

EBIT increased to 107 million euro, compared with 89 million in the first half of 2006, equivalent to 10.8% of revenues.

EBITDA reached 15.3% of revenues, increasing to 151 million euro against 132 million (+14.8%) in the same period of last year. EBITDA from ordinary operations was 145 million euro, equivalent to 14.6% of revenues, compared with 126 million euro in the first half of 2006 (14% of revenues).

Net income for the period was 70 million euro, with a growth of 10.2%, compared with 64 million for the first half of 2006, maintaining an unchanged percentage of sales.

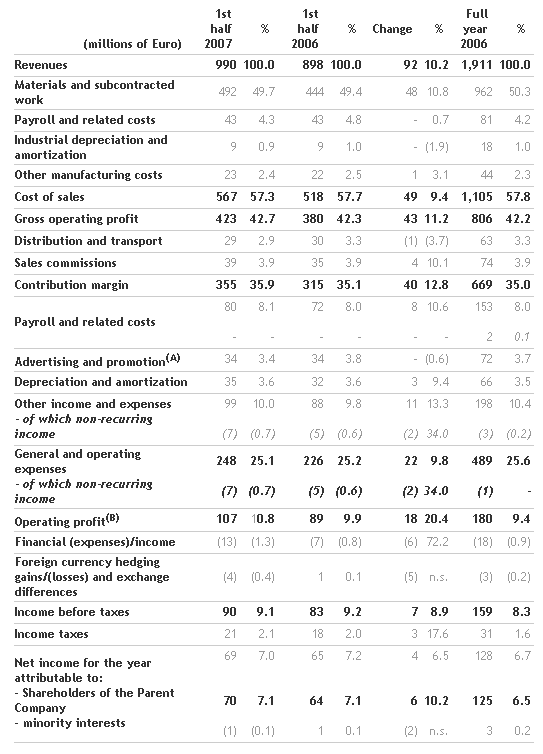

Highlights of the statement of income for the first half of 2007 and 2006 and for the full year 2006 are shown below; they are based on the statement of income classified by category (the percentage changes are calculated based on the precise values).

(A) Of which Euro 7 million invoiced by holding and related companies in first half of 2007 (Euro 11 million in 2006 and Euro 7 million in first half of 2006).

(B) Operating profit, before non-recurring items, amounts to Euro 100 million, corresponding to 10.1% of revenues (Euro 179 million in 2006, corresponding to 9.4% of revenues and Euro 84 million in first half of 2006, corresponding to 9.4%).

Figures not yet audited.

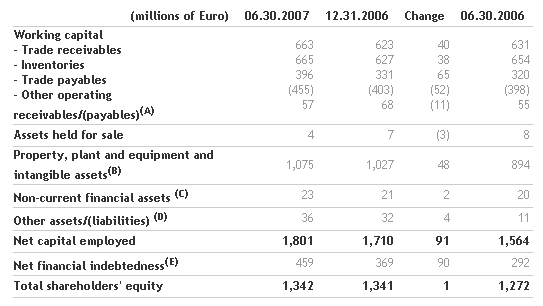

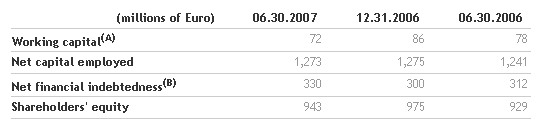

Consolidated balance sheet data at June 30, 2007

Compared with June 30, 2006, working capital increased by 32 million, due to the combined effects of:

- increase in inventories due to the different segmentation of collections and the management of continuative garments, as well as the higher number of directly operated stores;

- increase in trade payables due to higher volumes and better payment terms.

In addition to comments already made relating to working capital, capital employedincreased by a further 205 million, mainly due to the increase in expenditure on tangible and intangible fixed assets.

Compared with December 31, 2006, capital employed increased by 91 million euro, driven by an increase in working capital due to the cyclical nature of the business, in addition to the net increase in tangible and intangible fixed assets resulting fromgross operating capital expenditure in the half year of 101 million euro. The greater part of the capital expenditure, totalling 71 million, went to the commercial network. Production capital expenditure related mainly to increases in production capacity of the Croatian and Tunisian centres and of the Castrette di Villorba hub in Italy.

Other capital expenditure amounted to 12 million and concerned mainly Information Technology (start-up of SAP software relative to the sales cycle).

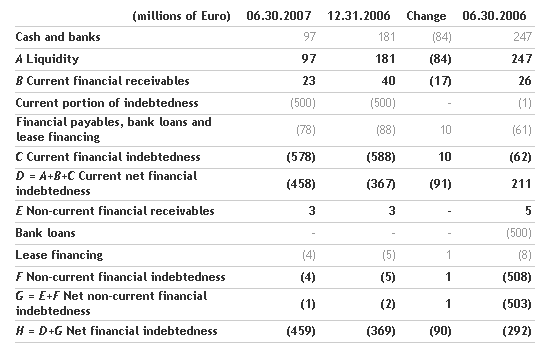

The most significant elements in the financial situation, compared with December 31 and June 30, 2006, were as follows:

(A) Other operating receivables and payables include VAT receivables and payables, sundry receivables and payables, holding company receivables and payables, receivables due from the tax authorities, deferred tax assets, accruals and deferrals, payables to social security institutions and employees, receivables and payables for the purchase of non-current assets etc.

(B) Property, plant and equipment and intangible assets include all categories of assets net of the related accumulated depreciation, amortization, and impairment losses.

(C) Non-current financial assets include unconsolidated investments and guarantee deposits paid and received.

(D) Other assets/(liabilities) include the retirement benefit obligations, the provisions for risks, the provision for sales agent indemnities, other provisions, deferred tax liabilities, the provision for current income taxes and deferred tax assets in relation to the Company reorganization carried out in 2003.

(E) Net financial indebtedness includes cash and cash equivalents and all short and medium/long-term financial assets and liabilities.

Figures not yet audited.

Net financial indebtness was 459 million euro compared with 292 million euro at June 30, 2006.

Figures not yet audited

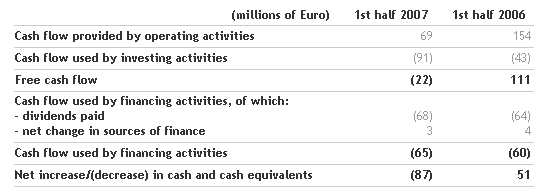

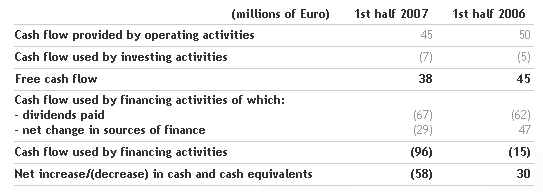

Cash flow in the first half of 2007

Free cash flow absorbed was 22 million euro. The result was influenced mainly by investments for the commercial network, development of the Croatian and Tunisian production centres and of the hub in Castrette di Villorba (Italy) and Information Technology; disposals in the period referred mainly to the sale of commercial companies located in Milan, Nantes and Avignon, as well as to production plant and machinery.

Free cash flow was also effected by the increase of the working capital associated with higher sales volumes and the different segmentation of collections.

Cash flows during the half-year are summarized below with comparative figures for the first half of the last financial year:

Figures not yet audited.

Outlook for the full year

For 2007, an improvement in consolidated revenues is forecast compared with forecasts given last spring, with growth ranging from 7 to 9%, due to the results of the 2007 Spring/Summer collections and progress of orders for the 2007 Fall/Winter collections.

It is forecast that EBITDA, calculated before non-recurring items, will show an increase of over 20%, with a percentage of revenues exceeding 15%.

Investments are forecast around 300 million euro and the net financial indebtness is forecast to be around 450 million by the end of 2007.

Alternative performance indicators

In this press release, in addition to the conventional financial ratios required by IFRS, some alternative performance indicators are provided in order to permit a better assessment of the Group’s profit and financial performance. However, these indicators must not be considered as replacing the conventional ratios required by IFRS.

Figures not yet audited.

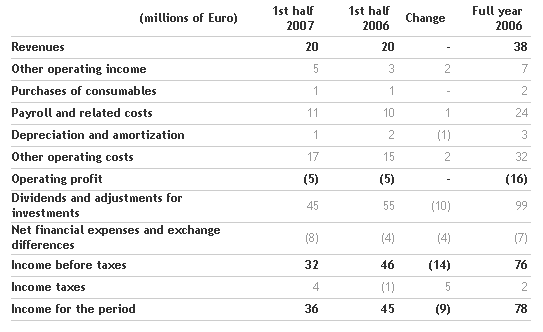

Benetton Group S.p.A. results

(Figures not yet audited)

Statement of income by nature of cost

Balance sheet and financial position highlights

(A) Working capital includes the book balances at the reporting date of: trade receivables less the related provision for doubtful accounts, trade payables and other operating receivables and payables (i.e. VAT receivables and payables, sundry receivables and payables, receivables and payables with the holding company, subsidiaries and associated companies, receivables due from the tax authorities, deferred tax assets, accruals and deferrals, payables to social security institutions and employees, receivables and payables for the purchase of non-current assets etc).

(B) Net financial indebtedness includes cash and cash equivalents and all short and medium/long-term financial assets and liabilities.

Cash flow statement

Delisting from NYSE and termination of registration in accordance with the Securities Exchange Act

Today the Board of Directors resolved to request the voluntary termination of the listing and registration of its own American Depositary Shares (ADS) at the New York Stock Exchange (NYSE) and the voluntary termination of its registration and of its duty to file reports pursuant to the Securities Exchange Act of 1934.

The decision was made in the light of the globalization process within the financial markets and of the internationalization of the Italian Stock Exchange, taking into account the low trading volumes in New York and due to the fact that even the principal American shareholders trade Benetton shares mainly on the Italian stock exchange.

Benetton Group, which adheres to the standards required by the American legislation of 2002, the Sarbanes Oxley Act, will continue to maintain a level of internal control, corporate governance and financial reporting in accordance with the highest international standards, in addition, naturally, to the full respect of Italian legislation governing savings.

The delisting and deregistration of Benetton Group do not affect the Group’s business strategy in the United States.

In the next few days, Benetton Group will file Form 25 and Form 15F to the Securities Exchange Commission (SEC), subsequently following the procedures and timing provided by the new simplified procedure recently approved by SEC.

Benetton Group has not arranged for listing and/or registration of its ordinary shares or ADSs on any other U.S. national securities exchange or quotation medium (as defined in Rule 15c 2-11 under the Exchange Act).

The Company will maintain its Level 1 American Depository Receipt programme. Ordinary shares will remain listed on the Italian Stock Exchange, constituting the primary trading market.

The Company will continue to make its annual and interim reports and press releases available on its website (www.benettongroup.com), also in English.

Declaration by the Manager Responsible for the preparation of company accounting documents.

The Responsible Manager, Emilio Foà, has issued a written declaration in accordance with art. 154 bis, II paragraph of the Tax Consolidation Act, attached to the Half Year Report to June 30, 2007, stating that this latter, on the basis of what he knows, corresponds to the documentary results, books and accounting records.

Disclaimer

The document includes forward-looking statements, in particular in the section “Outlook for the full year”, relative to future events and income and financial operating results of the Benetton Group. These forecasts, by their nature, include an element of risk and uncertainty, since they depend on the outcome of future events and developments. The actual results may differ even quite significantly from those stated due to a multiplicity of factors.

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi