- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

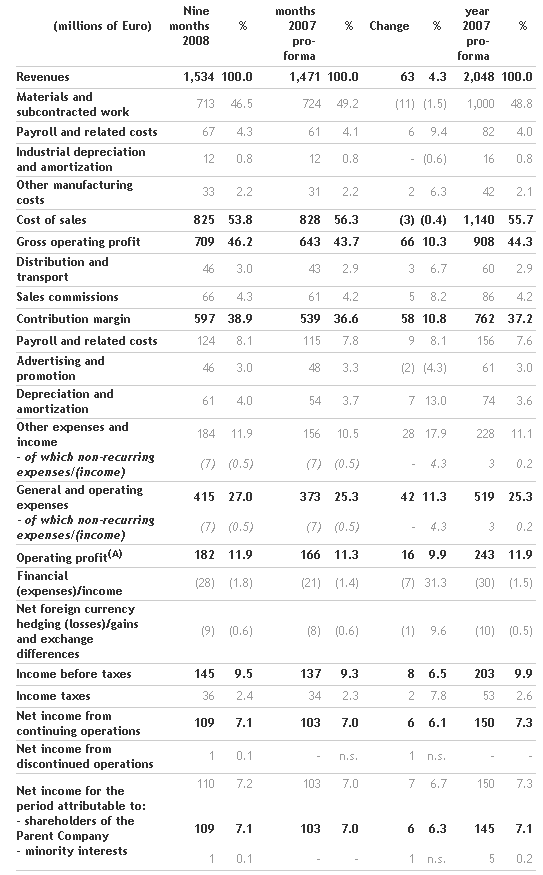

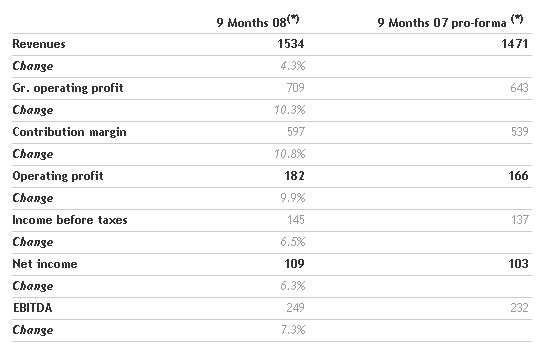

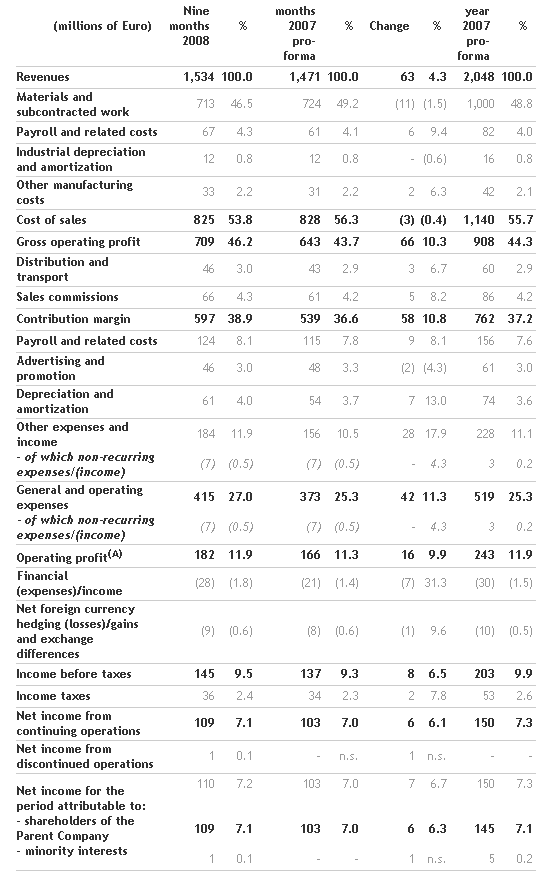

Board of Directors approves nine months results

Benetton Group consolidated revenues increase to 1,534 million euro (+6.3%, currency neutral)

Ponzano, November 13, 2008 - The Benetton Group Board of Directors, meeting today and chaired by Luciano Benetton, examined and approved the consolidated results for the first nine months of 2008.

Group net revenues for the first nine months of 2008 grew to 1,534 million euro (+4.3%), consistent with the full year revenue forecast previously announced; this increase, after eliminating exchange impacts (currency neutral) and on a like for like basis, was equivalent to 6.3%.

*Values in millions of euro

Growth in the nine months was determined, in particular, by enrichment of the offer with higher value product categories and by the significant increase in the number of items sold. Growth was partially attenuated by the appreciation of the euro against major foreign currencies, in particular the Korean won, the US dollar, the Indian rupee and the British pound.

Gross operating profit reported a margin of 46.2% of revenues compared with 43.7% in the first nine months of 2007, with an increase of 66 million euro. This increase was principally influenced by the combined effect of the increase in volumes and the ever more efficient management of the supply chain and sourcing activities, in a context of constant attention to product quality.

The contribution margin increased by 58 million to 597 million euro, rising to 38.9% of revenues from 36.6%, including a slight increase in variable costs associated in particular with the cost of oil and transport.

The most significant elements in the period which impacted on general and administrative expenses (+42 million euro) were:

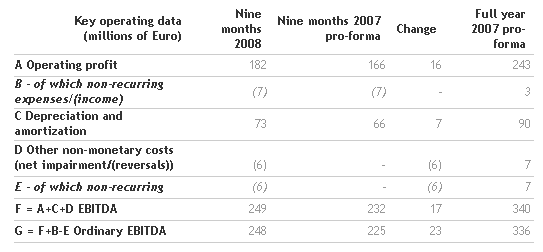

Operating profit grew by 16 million to 182 million euro, with a percentage of revenues of 11.9% compared with 11.3% in the first nine months of 2007.

EBITDA increased by 17 million to 249 million euro, equivalent to 16.3% of revenues, against 15.8% in the comparative period. As a result of increases in average financial indebtedness and interest rates, and appreciation of the euro against the principal currencies, financial expenses and currency hedging increased by 8 million euro.

Net income, of 109 million euro, grew by 6.3%.

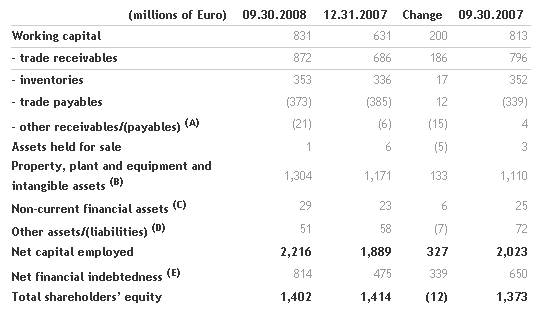

Capital employed increased by 327 million euro compared with December 31, 2007; this was mainly driven by the cyclical movement in working capital and the net increase in tangible, intangible and financial assets. Working capital registered a modest increase (+18 million euro compared with September 30, 2007).

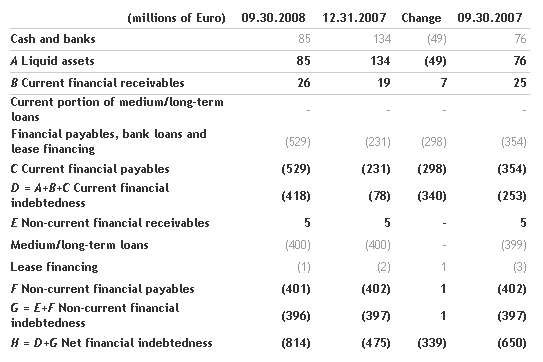

Net financial indebtedness was 814 million euro compared with 650 million at September 30, 2007.

Since May 2008 the Group has proceeded with the repurchase of Company shares for an amount of 52 million euro (at September 30, 2008); in accordance with international accounting principles, the figure has been reported in shareholders’ equity.

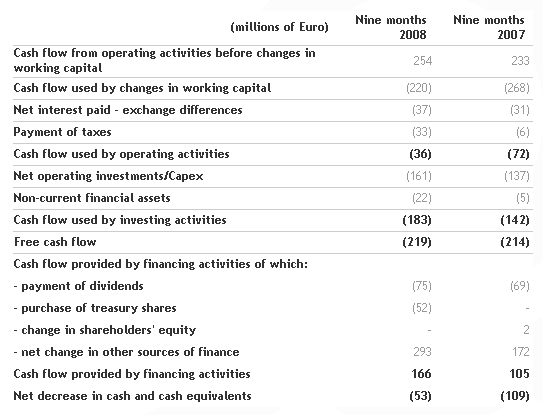

Cash flow used by operating activities improved by around 36 million euro compared with the corresponding period in 2007.

BRANDS

Revenues of all Group brands increased in the period. Growth was driven, in particular, by new openings and the positive contribution of sales per square metre.

Benefits of projects initiated in prior periods were confirmed by the increase in average price due to improvements in mix.

The United Colors of Benetton adult brand recorded growth in performance, especially in Europe: new openings were well received from Genoa to Helsinki, from Astana (Kazakhstan) to Riga (Latvia), to name a few.

Sisley produced a positive performance in Asia (8 new stores in India alone). Sisley Young, for fashion-conscious youngsters, opened its first store in Taipei (Taiwan): the brand’s most representative showcase in the Asian market. Following the debut success of its Christmas Season collection, the totally new Sisley Underwear line, men’s and women’s underwear and accessories with a sensual and chic style and a strong fashion content, launched its 2009 Spring/Summer collection with a series of special events. This line, which will establish its identity in corners and monobrand stores of innovative design, has plans for three openings in Italy and abroad within the year, joining its existing corners which number over 150.

Playlife was particularly positive in Italy, with the opening of around 20 new stores during Fall/Winter 2008.

MARKETS

Results by geographic area in the nine months were impacted by strong exchange rate fluctuations.

Europe increased by 4% in the nine months (currency neutral), and the Mediterranean Area in particular grew by 4.3%, with a positive trend in countries such as Italy, France and Greece. Asia achieved 15.7% growth in revenues in the period (currency neutral). In particular, there was a significant strengthening of activities in the Middle East area where the company has set up commercial offices in Dubai, in order to monitor the market more closely, supervise the area in a more specific way and exploit all business opportunities. Specifically, for the development of the Qatar market, a cooperation agreement was signed with the Al Mana Fashion Group, which is recognised in the fashion sector for reliability, performance, quality of service and results.

In the Americas, of particular note are the continuing development of the Mexican market and the consolidation of United States activities, now directly managed by the new regional offices in Miami.

The group of Emerging Markets, with high growth potential (Russia and ex USSR countries, Turkey, India, Greater China, Central and South America), grew by 27% in the period (currency neutral), increasing its proportion of total Group revenues to 11% from 9% in 2007. In particular, in Russia and ex-USSR countries 26 new stores, including a number of important megastores in the main cities, were recently opened. India confirmed growth of 40% (currency neutral) and saw the opening of 41 new stores in the first nine months of 2008. Particularly noteworthy is the opening of the first Benetton Man store in New Delhi: over 300 square metres totally dedicated to casual and formal wear. Development of the strategic partnership with the Tata Group continued, with a total of 8 openings.

INVESTMENTS

In the first nine months of 2008, net investments amounted to 183 million euro compared with 142 million in the corresponding period of 2007.

Investments for the commercial network predominated, with an amount of 147 million euro, including those relative to the acquisition of shareholdings and commercial businesses, in particular in the United States and Italy.

Investment in production, amounting to 37 million euro, was mainly dedicated to increasing the distribution hub in Castrette di Villorba (Italy) and the capacity of the production facilities in Tunisia and Romania.

Other investments amounted to 17 million euro and related mainly to IT; the most significant was that for the integrated management of directly operated stores and extension of the SAP application software to some foreign subsidiaries.

Disposals of 37 million euro in the period related mainly to:

OUTLOOK FOR THE FULL YEAR

In the light of the nine months results, the Group confirms its commitment to achieving the 2008 full year objectives.

Gerolamo Caccia Dominioni, CEO of Benetton Group, commented “the results achieved in the nine months are satisfactory and the capacity of the company to channel its energies into achieving the operational choices undertaken should be emphasized. It is now essential for the Group to act with even more rapidity in view of the economic situation the markets will be facing in the coming months”.

In consideration of actions already put in place by the management to contain and compensate for the negative impact of these factors, revenues are expected to grow by 6% (currency neutral), and net income to be up by around 7% compared with 2007.

Investments in the year should be around 250 million euro and, in particular:

- investment projects to double the size of the Castrette logistics hub (in Italy) and regarding the production facility in Tunisia will be completed;

- investment will continue for the opening of new stores in markets considered to be strategic for the Group;

- implementation of business support IT systems will continue. The objective of net financial indebtedness around 650 million euro by the end of the current year is confirmed.

Declaration by the manager responsible for preparing the company's financial reports

The manager responsible for preparing the company's financial reports, Emilio Foà, declares, pursuant to paragraph 2 of Article 154-bis of the Consolidated Law on Finance, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

As previously announced, with the approval of the results of the first nine months of 2008, Emilio Foà leaves his position as manager responsible for preparing the company’s financial reports. The Board of Directors, during today’s meeting, assigned this position to Lorenzo Zago, Director of Administration and Reporting.

Disclaimer

This document contains forward looking statements, specifically in the section entitled “Outlook for the full year”, relating to future events and operating, economic and financial results of the Benetton Group. By their nature, such forecasts contain an element of risk and uncertainty, because they depend on the occurrence of future events and developments. The actual results may differ, even significantly, from those announced for a number of reasons.

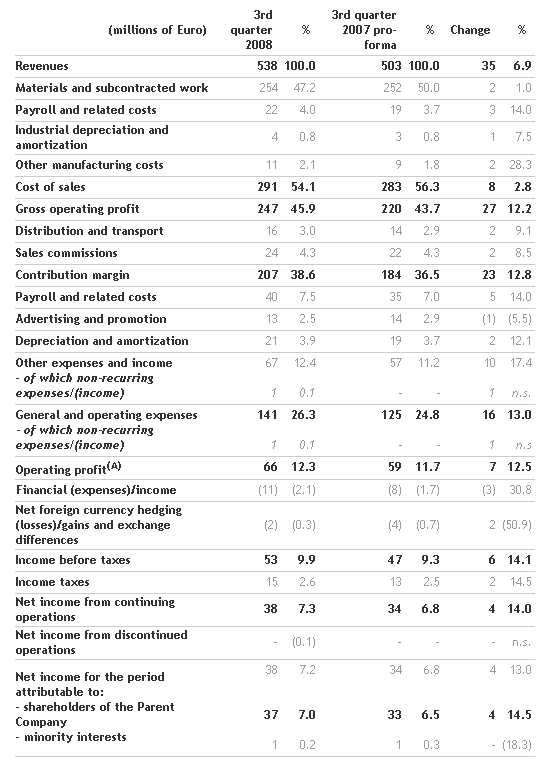

Consolidated Benetton Group results

(unaudited)

On April 1, 2008 the Group sold its residual sports equipment manufacturing business in Hungary to third parties, meaning that the income and expenses of the discontinued operations have been reclassified and reported in a single line in the statement of income "Net income from discontinued operations". The related figures for the corresponding period in 2007 have also been reclassified to make them comparable with 2008.

Consolidated statement of income

As stated previously, after the amounts relating to the discontinued sports equipment operations were reclassified, the figures for 2007 have been restated to make them consistent with those in 2008.

(A) Operating profit before non-recurring items was 175 million, representing 11.4% of revenues (159 million in first nine months 2007, representing 10.8% of revenues, and 246 million in 2007 representing 12.1% of revenues).

(A) Operating profit before non-recurring items was 67 million, representing 12.4% of revenues (59 million in third quarter 2007, representing 11.7% of revenues).

Balance sheet and financial position highlights

Management has decided to present working capital in the strict sense of the term, meaning that direct taxation has now been excluded, also in keeping with requests from the financial community. As a result, the following items have been reclassified from "Other receivables/(payables)" to "Other assets/(liabilities)": deferred tax assets and liabilities, receivables due from the tax authorities for direct taxes and receivables and payables from/to holding companies in relation to the group tax election.

(A) Other receivables/(payables) include VAT receivables and payables, sundry receivables and payables, trade receivables and payables from/to Group companies, accruals and deferrals, payables to social security institutions and employees, receivables and payables for fixed asset purchase etc.

(B) Property, plant and equipment and intangible assets include all categories of assets net of the related accumulated depreciation, amortization, and impairment losses.

(C) Non-current financial assets include unconsolidated investments and guarantee deposits paid and received.

(D) Other assets/(liabilities) include retirement benefit obligations, provisions for legal and tax risks, the provision for sales agent indemnities, other provisions, current income tax liabilities, receivables and payables from/to holding companies in relation to the group tax election, receivables from the tax authorities for direct taxes, deferred tax assets also in relation to the company reorganization carried out in 2003 and deferred tax liabilities.

(E) Net financial indebtedness includes cash and cash equivalents and all short and medium/long-term financial assets and liabilities.

Financial position

Cash flow statement

Alternative performance indicators

In addition to the standard financial indicators required by IFRS, this press release also contains a number of alternative performance indicators for the purposes of allowing a better appreciation of the Group's financial and economic results. These indicators must not, however, be treated as replacing the standard ones required by IFRS. The following table shows how EBITDA and ordinary EBITDA are made up.

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi