- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

The Benetton Group Board of Directors approves the 2009 financial statements and proposes a dividend of 0.23 euro per share

- 2009 consolidated revenues 2,049 million euro

- Ordinary EBITDA at 16.2% (16.6% in 2008)

- Net income 122 million euro

- Excellent cash generation in the year: over 130 million euro and consequent reduction in indebtedness to 556 million euro (689 million euro at December 2008)

- Proposed dividend of 0.23 euro per share

- First quarter 2010 revenues forecast in line with the same period of 2009

Proposal to appoint Franco Furnò and Biagio Chiarolanza to the Board, delegating operative management of the company, and strengthening the process of managerialization - The Board of Directors thanks CEO Gerolamo Caccia Dominioni, whose term of office naturally expires, for the commitment and enthusiasm consistently demonstrated during his mandate

Ponzano, March 18, 2010 - The Benetton Group S.p.A. Board of Directors has approved the draft 2009 financial statements(1).

2009, a year characterized by a strongly negative international economic situation, particularly in the geographical areas of greater relevance to the Group, confirmed the strength of the latter which achieved gratifying financial results, reinforcing the soundness of its financial position and balance sheet. The year just closed featured far-reaching investments focussed on development and strengthening service to the network of commercial partners, in addition to intensive work carried out in the areas of product sourcing and costs.

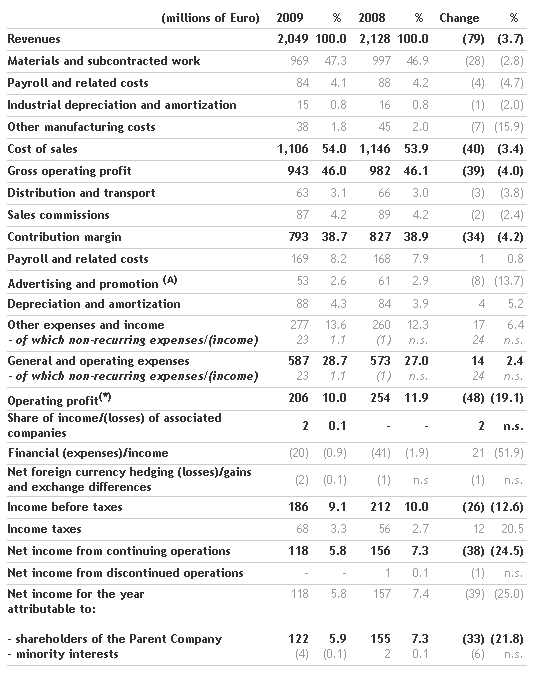

Profit and Loss performance

Group net revenues for 2009 were 2,049 million euro compared with 2,128 million in 2008, a record year, with a reduction of 3.7% (-3% currency neutral).

Apparel segment sales to third parties were 1,947 million euro, down by 87 million compared with 2008.

The result achieved in emerging countries, up overall by 14.8% currency neutral, was particularly satisfying, while in established markets the Group’s traditional point of strength, Italy, held up better.

Due to the numerous initiatives promptly launched at the first signs of the economic crisis, EBITDA from ordinary operations was 332 million euro, equivalent to 16.2% of revenues (353 million in 2008, 16.6% of revenues), while EBIT from ordinary operations was 229 million euro, equivalent to 11.1% of revenues (254 million in 2008, 11.9% of revenues). The result is due substantially to the achievement of increasing efficiency in the supply chain, unceasing attention to quality and the optimisation of industrial costs in support of gross operating profit, as well as to a reduction in structural costs. Overall, savings generated by the reorganization programme yielded benefits of 58 million euro, an amount exceeding initial expectations.

These positive results were also achieved by actions which entailed non-recurring expenses totalling 23 million euro, compared with income of 0.6 million euro recorded in 2008.

The reduction in interest rates and the excellent performance in the reduction of indebtedness, particularly in the final part of the year, resulted in an improvement in financial expenses, from 42 million euro in 2008 to 22 million in 2009.

The Group tax rate grew as a result of higher losses recorded by foreign subsidiary companies and due to the impact of fixed asset write-downs.

Net income for the year was thus 122 million euro, compared with 155 million in 2008, equivalent to 5.9% of revenues (7.3% in 2008).

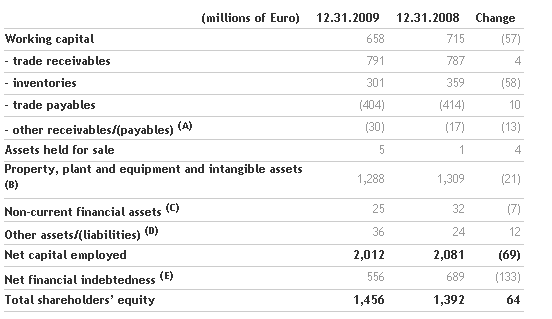

Balance sheet and financial position

Working capital reduced by 57 million euro compared with December 31, 2008, due mainly to lower inventories, achieved as a result of reorganization programme actions. Trade receivables of 791 million euro were unchanged (+4 million compared with December 2008) with a slight worsening in the collection rate caused by difficulties experienced by some clients in obtaining credit, mostly in emerging markets. On the other side, trade payables decreased to 404 million euro (-10 million compared with December 2008), notwithstanding longer terms of payment negotiated with a number of suppliers, off-set by lower purchases.

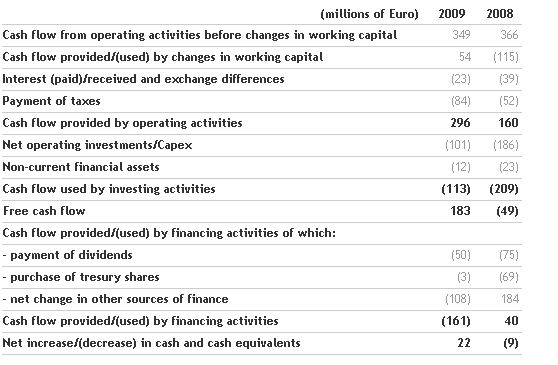

Total net investments were 113 million euro (209 million in 2008) and focussed on development of the sales network, mainly in the Italian, Spanish and French markets, as well as in priority development countries such as Russia, Mexico, Turkey and India. Production investments were again significant in 2009, totalling 31 million, relating to manufacturing facilities in Romania, Italy and Istria (Croatia) and investments in Information Technology.

Capital employed was 2,012 million euro, 69 million lower than in December 2008, almost entirely due to the changes in working capital illustrated above and the remainder due to the net reduction in tangible and intangible fixed assets.

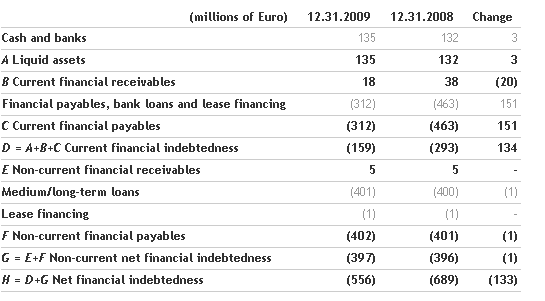

Net Group financial indebtedness reduced to 556 million euro compared with 689 million at December 31, 2008, due to a significant level of cash generation. This result was achieved due to the above-mentioned reduction in net working capital, in spite of the large investment programme commented on previously.

A credit line of 500 million euro, originally negotiated for a period of 5 years with a pool of banks, will expire at the beginning of June. During the current month, the Group has reached an agreement with five first-class banks for the arrangement of a new facility totalling 400 million euro, effective from the expiry of the above-mentioned credit line, divided between a fixed-term loan of 250 million euro with a duration of five years up to June 2015 and a revolving loan, with the same five year duration, of 150 million euro.

Therefore, as from the month of June, following signature of the contractual agreement, 400 million euro could be available to the Company, in addition to credit lines of 460 million euro already in existence giving an overall total of 860 million euro, with durations between two and a half years and five years; an additional 430 million euro in revocable credit lines are also available.

Dividend payment and other deliberations

The Board then approved the draft annual financial statements(1) of the Parent Company and submitted a proposal to the next Shareholders Meeting, convened at Ponzano for April 22 (first call and April 23, second call), for payment of a dividend totalling around 40 million euro, equivalent to 0.23 euro per share (0.28 euro per share in 2009). Payment of the dividend is planned as from May 6, 2010, with coupon detachment date on May 3, 2010.

On April 22nd the Shareholder’s meeting will also be called to deliberate the appointment of the Board of Directors, expiring with the approval of the 2009 financial statements.

On the same date, the appointment to the Board of Directors of Messrs. Franco Furnò and Biagio Chiarolanza will be proposed, with the intention of delegating to them the operational management of the Company.

Franco Furnò will head the Commercial, Product and Human Resources areas. Biagio Chiarolanza will have responsibility for Administration, Finance and Control, Operations as well as for the foreign Business Units.

Franco Furnò will bring to this role expertise gained while working for important fashion and large-scale retail trade groups such as Gucci, Marzotto, Pam and Benetton Group.

Biagio Chiarolanza will exploit a twenty-year experience in the Benetton Group both in Italy and in its foreign subsidiaries.

The Board of Directors warmly thanks the CEO Gerolamo Caccia Dominioni, whose term of office will naturally come to an end at the Shareholder’s meeting of April 22nd, for the commitment and enthusiasm he has consistently demonstrated during his mandate.

The Board approved a report for submission to the Shareholders’ Meeting relating to authorization for the purchase and sale of Company shares with the terms and conditions illustrated below, subject to revocation, for the part not yet executed, of the authorization by the shareholders' meeting resolution of 20 April 2009.

Authorization is requested for the purchase of a maximum number of shares which, together with the shares currently held, does not exceed the limit of 10% of the share capital and for a period of 18 months. The minimum purchase price is envisaged as not less than 30% under, and the maximum price not more than 20% over, the reference price recorded by the share in the stock exchange session preceding each individual transaction; the selling price is envisaged as not less than 90% of the reference price recorded by the share in the stock exchange session prior to each individual transaction. The authorization is requested to enable the Company to acquire a portfolio of treasury shares, which may also be used to serve any share incentive schemes. This authorization would also give the Company the power to act on its own shares, for the purposes and in the ways permitted by current legislative provisions, also taking advantage of any strategic investment opportunities.

The purchases will be made in markets regulated, organized and managed by Borsa Italiana S.p.A. and in accordance with its procedures. The Company currently holds 10,345,910 treasury shares, corresponding to 5.663% of share capital.

Finally the Board approved the Report on corporate governance and ownership structure provided by Article 123 bis of Consolidated Law on Finance relating to the 2009 financial year, prepared in compliance with the last edition of Format proposed by Borsa Italiana.

Outlook for the year

Collection of Spring/Summer orders is drawing to an end, showing a trend in line with the previous collection, while expectations for the next Autumn/Winter collection are better, due to a forecast for a modest recovery in consumption. In particular, revenues for the first quarter of 2010 are expected to be in line with the same period of 2009. Due to the far-reaching actions initiated in 2009, and further cost reduction programmes currently being launched, the Company is anticipating that operating profit will be substantially stable as a percentage of revenues. In the second half of the year however, the negative effects of increased interest rates on the new loans will be felt, and the tax rate will be maintained at 2009 levels. The net financial position should additionally improve, notwithstanding an increase in investment.

Declaration by the manager responsible for preparing the company's financial reports

The manager responsible for preparing the company's financial reports, Alberto Nathansohn, declares, pursuant to paragraph 2 of Article 154-bis of the Consolidated Law on Finance, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Disclaimer

This document includes forward-looking statements, specifically in the section entitled “Outlook for the year”, relating to future events and operating, economic and financial results of the Benetton Group. By their nature, such forecasts contain an element of risk and uncertainty, because they depend on the occurrence of future events and developments. The actual results may differ significantly from those announced for a number of reasons.

(1) The consolidated financial statements and the draft annual financial statements are currently being audited and, as of today’s date, the audit is not yet complete.

Benetton Group consolidated results

The consolidated financial statements and the draft annual financial statements are currently being audited and, as of today’s date, the audit is not yet completed.

Consolidated statement of income

(A) Of which 11 million invoiced by holding and related companies in 2009 (11 million in 2008).

*Operating profit, before non-recurring items, amounts to 229 million, corresponding to 11.1% of revenues (254 million in 2008 with a margin of 11.9%).

Balance sheet and financial position highlights

(A) Other receivables/(payables) include VAT receivables and payables, sundry receivables and payables, trade receivables and payables from/to Group companies, accruals and deferrals, payables to social security institutions and employees, receivables and payables for fixed asset purchases etc.

(B) Property, plant and equipment and intangible assets include all categories of assets net of the related accumulated depreciation, amortization, and impairment losses.

(C) Non-current financial assets include unconsolidated investments and guarantee deposits paid and received.

(D) Other assets/(liabilities) include retirement benefit obligations, provisions for legal and tax risks, the provision for sales agent indemnities, other provisions, current tax receivables and liabilities, receivables and payables due from/to holding companies in relation to the group tax election, deferred tax assets also in relation to the company reorganization carried out in 2003, deferred tax liabilities and payables for put options.

(E) Net financial indebtedness includes cash and cash equivalents and all short and medium/long-term financial assets and liabilities.

Financial position

Cash flow statement

Alternative performance indicators

In addition to the standard financial indicators required by IFRS, this press release also contains a number of alternative performance indicators for the purposes of allowing a better appreciation of the Group's financial and economic results. These indicators must not, however, be treated as replacing the standard ones required by IFRS.

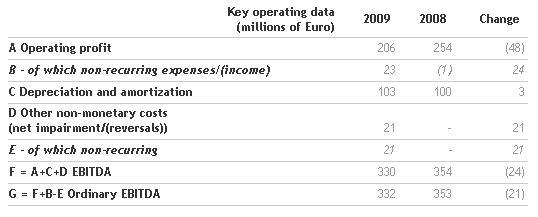

The following table shows how EBITDA and ordinary EBITDA are made up.

Benetton Group S.p.A. results

The consolidated financial statements and the draft annual financial statements are currently being audited and, as of today’s date, the audit is not yet completed.

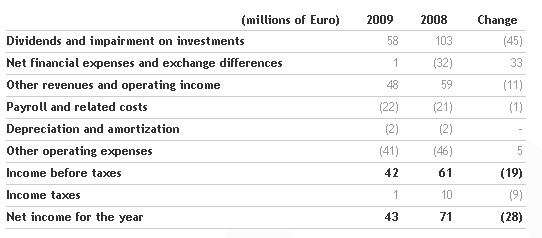

Income statement

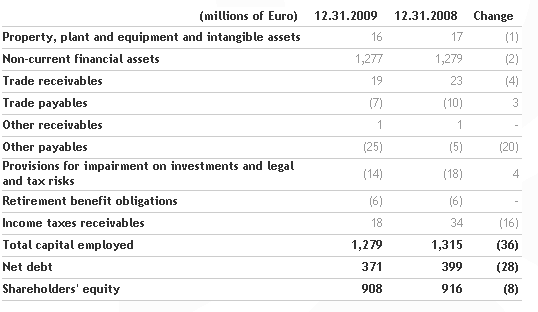

Balance sheet and financial position highlights

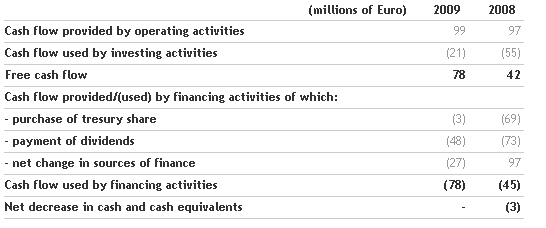

Cash flow statement

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi