- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS25

- Sisley - SS25

- United Colors of Benetton - FW24

- Undercolors of Benetton - FW24

- Sisley FW24

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- Never Ending Wool - 50-Year Partnership with Woolmark

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2025

- Sisley – S/S 2025

- United Colors of Benetton - FW24 - Adult

- United Colors of Benetton - FW24 - Kids

- Sisley F/W 2024

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- Sisley S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

Transition of the Benetton Group to IFRS for the 2004 full year and First Half Consolidated Financial Statements

Minimal impact on the net financial position and shareholders’ equity. Revised net income 2004 down around 14 million euro

Ponzano, 7 September 2005 - The Benetton Group has reclassified its consolidated financial statements relative to the first half of 2004 (to June 30, 2004) and the year 2004 (to December 31, 2004) as required by the International Financial Reporting Standards (IFRS). The Benetton Group will prepare its consolidated financial statements in accordance with IFRS principles as from the 2005 half year. The parent company Benetton Group S.p.A. will adopt IFRS principles as from the 2006 financial statements.

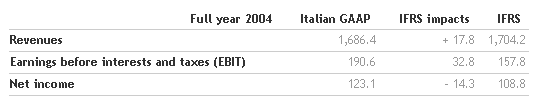

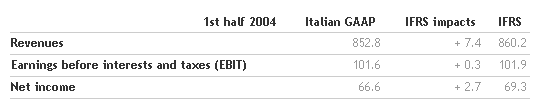

The main differences between Italian and IFRS accounting principles in the consolidated results for the first half of 2004 and the 2004 full year are shown below.

Consolidated statement of income

Annual revenues are affected by the application of IAS 18, increasing by around 18 million euro due to the consolidation of commercial activities in South Korea at retail sales values.

EBIT in accordance with IFRS rules adopted by the Group will now include extraordinary income and expenses, reclassified to operating categories.

Net income for the 2004 financial year is affected in particular by the IFRS principles listed below:

Un-audited data

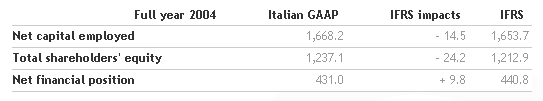

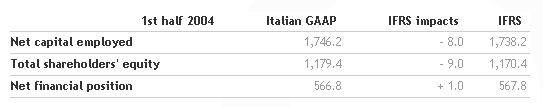

Consolidated balance sheet

Following application of IFRS, total shareholders’ equity at June 30, 2004 reduces by 9 million euro (1,170 million) and by 24 million euro at December 31, 2004 (1,213 million).

The net financial position increases by one million euro at June 30, 2004 (568 million) and by 10 million euro at December 31, 2004 (441 million).

Un-audited data

The management will illustrate the reclassification of consolidated financial statement values relative to 2004 in a conference call tomorrow September 8 at 10:00 a.m.

To access the conference call dial +39 06 33485042 (www.benettongroup.com/investors)

The Benetton Group will present the results for the first half-year 2005 on September 21, 2005.

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi