- Press Releases and Statements

- Image Gallery

- Corporate

- Collections

- United Colors of Benetton - SS24

- Undercolors of Benetton – SS24

- Sisley - SS24

- United Colors of Benetton – FW 2023

- Undercolors of Benetton – FW 2023

- Sisley – FW 2023

- United Colors of Benetton – SS 2023

- Undercolors of Benetton – SS 2023

- Sisley – SS 2023

- United Colors of Benetton – FW 2022

- Undercolors of Benetton – FW 2022

- Sisley – FW 2022

- Sisley Young – FW 2022

- United Colors of Benetton – SS 2022

- Undercolors of Benetton – Spring 2022

- Sisley – SS 2022

- Institutional Communication

- Historical Campaigns

- Other Campaigns

- The Hope Project

- Integration Project

- Naked, Just Like

- United in diversity

- Migrants Images

- Power her Choices

- United By Half

- Clothes for Humans

- SAFE BIRTH EVEN HERE

- We. Campaign

- UN Women Campaign

- #IBelong Campaign

- Unemployee of the Year

- Unhate

- It's My Time

- Victims

- Microcredit Africa Works

- James and Other Apes

- Food for Life

- Volunteers

- Brand Communication

- United Colors of Benetton – S/S 2024 - Adult

- United Colors of Benetton – S/S 2024 - Kids

- Undercolors of Benetton – S/S 2024

- United Colors of Benetton – F/W 2023

- Sisley F/W 2023

- United Colors of Benetton – S/S 2023

- Sisley - S/S 2023

- United Colors of Benetton – F/W 2022 – Adult

- United Colors of Benetton – F/W 2022 – Kids

- United Colors of Benetton – S/S 2022 – Adult

- United Colors of Benetton – S/S 2022 – Kids

- Sisley – F/W 2022

- Sisley – S/S 2022

- Stores

- Austria

- Chile

- Croatia

- Czech Republic

- France

- Germany

- Greece

- India

- Ireland

- Italy

- Aosta - P.za Emile Chanoux

- Ancona - Corso Garibaldi

- Bari - Via Sparano

- Brescia - Corso Zanardelli

- Capri - Via Vittorio Emanuele

- Como - Via Luini

- Cortina d'Ampezzo

- Forte dei Marmi - Via Carducci

- Foggia - Corso Vittorio Emanuele

- Florence - Santa Maria Novella railway station

- Florence – Via Cerretani

- Latina - Via Armando Diaz

- Mantova - Corso Umberto

- Marghera - SC Nave de Vero

- Merano - Via Libertà

- Milan – C.so Buenos Aires, 19

- Milan – C.so Vittorio Emanuele

- Milan – P.za San Babila

- Naples – Palazzo Berio

- Novara - Corso Italia 6

- Padua – Via E. Filiberto

- Padua – Via Roma

- Palermo - Piazza Regalmici

- Pescara – C.so Vittorio Emanuele

- Rome - Fontana di Trevi

- Rome - Via del Corso

- Treviso - P.za Indipendenza

- Treviso - Via XX Settembre

- Turin - Via Roma

- Udine - C.C. Città Fiera

- Verona – Via Mazzini

- Venice - Mercerie

- Venice - Campo San Bortolomio

- Vicenza – C.so Palladio

- Viareggio

- Kosovo

- Mexico

- Norway

- Poland

- Portugal

- Russia

- Serbia

- Slovenia

- Spain

- Switzerland

- Turkey

- United Kingdom

- USA

- Fabrica

- Colors Magazine

- Ponzano Children

- Events

- Video Gallery

- Corporate

- Institutional Communication

- Integration Project

- Naked, Just Like

- Power Her Choices

- UNITED BY HALF

- Clothes for Humans - Campaign

- Clothes for Humans - Manifesto

- Clothes for Humans - Manifesto (Italiano)

- Clothes for Humans - Manifesto (English)

- Clothes for Humans - Manifesto (Español)

- Clothes for Humans - Manifesto (Français)

- Clothes for Humans - Manifesto (Deutsch)

- Clothes for Humans - Manifesto (Ελληνικά)

- Clothes for Humans - Manifesto (Português)

- Clothes for Humans - Manifesto (Pусский)

- SAFE BIRTH EVEN HERE

- We. Campaign

- United Colors of Benetton in support of UN Women

- Unemployee of the Year - The film

- Unemployee of the Year - Press Meeting in London

- Unhate - The film

- Unhate - Press Meeting in Paris

- It's My Time - Teaser Video

- It's My Time - Live from NYC

- Microcredit Africa Works - Interview with Youssou N'Dour

- Microcredit Africa Works - Cartoon 'Birima Son of Africa'

- Microcredit Africa Works - Birima

- Brand Communication

- United Colors of Benetton – F/W 2023

- SISLEY - F/W 2023

- United Colors of Benetton – S/S 2023

- United Colors of Benetton – F/W 2022

- SISLEY - S/S 2023

- SISLEY - F/W 2022

- SISLEY - S/S 2022 - CITY GARDEN

- SISLEY - S/S 2022 - UNDYED

- United Colors of Benetton – F/W 2021 – Adult

- United Colors of Benetton – F/W 2021 – Kids

- Stores

- Fabrica

- Sustainability

- Events

- Press Kit

- Events

- Contacts

2010 first half results approved by the Board of Directors

Benetton Group, positive first half year

- Revenues €891 million (+1%, currency neutral -0.6%).

- Revenues stable in Italy, strong growth in Asia.

- Income from operations €63 million (7.1% of revenues)

- Net income €40 million (4.5% of revenues)

- Net financial position further improved, €508 million.

- Commercial investments stable in first half, strong increase in the rest of the year.

Ponzano July 30, 2010 – The Benetton Group Board of Directors examined and approved the consolidated results for the first half of 2010.

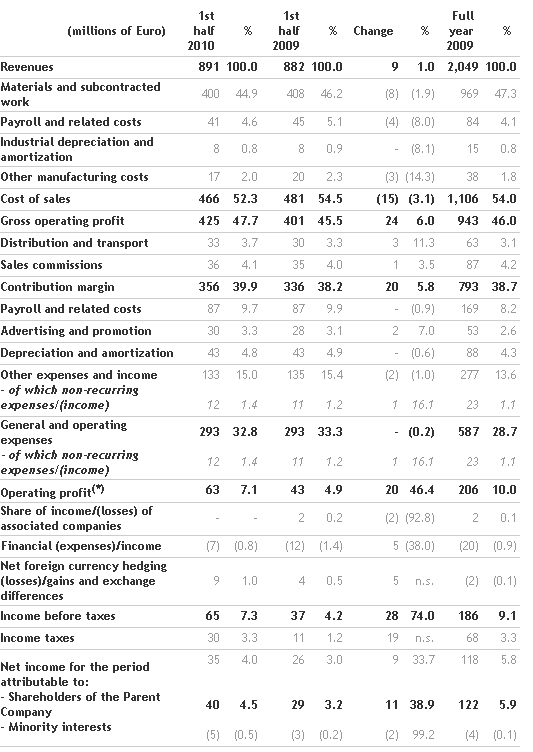

Consolidated income statement

Group net revenues for the first half of 2010, characterised by continuing economic uncertainty in many countries of importance to the Group, reached €891 million (+1% over the comparative half year, corresponding to €9 million). Product mix contributed to this improvement, with a predominance of higher unit value categories; added to this was a positive trend against the euro of some important foreign currencies in the Group’s geographical mix. Again this year, as in 2009, we have reaffirmed the policy of matching deliveries of the Fall/Winter collection with the seasonal requirements of the sales network, continuing an attentive policy of improved service to clients. Consequently, a large part of the deliveries of these collections will be despatched in the third quarter.

Group brands achieved good results in the half year, with growth of Sisley and the 012 and Sisley Young brands, while the UCB brand substantially maintained its position.

Geographically, in established markets, the slow-down in Greece and Spain was offset by a solid performance in Italy. Regarding emerging markets, whose proportion of total sales increased to 13%, the strong growth achieved in Mexico (+60% currency neutral) and in India is of special note.

Gross operating profit of €425 million (47.7% of net revenues) was up (+€24 million) compared with €401 million (45.5%) in the comparative half year, due to the decisive contribution of efficiencies achieved in manufacturing and sourcing.

The contribution margin was €356 million (39.9% of revenues), compared with €336 million (38.2%) in the corresponding period of 2009, up by €20 million.

Due to the cost reduction actions launched during 2009, general expenses for the first six months of 2010 were maintained overall at the same level as in the comparative half year, even though there was an increase in advertising investments. There was, moreover, a further increase in non-recurring charges relating, among others, to the rationalisation program for directly operated stores, in particular in the USA.

As a result, operating profit (EBIT), was €63 million, up compared with €43 million in the corresponding period of 2009, with a percentage to revenues of 7.1%, compared with the previous 4.9%.

Improvements in financial management were associated primarily with the reduction in average indebtedness, containing interest expenses from €12 million in the first half of 2009 to €7 million in 2010, and the usual hedging operations to cover foreign exchange risks.

Net income, finally, was €40 million (4.5% of revenues), compared with €29 million (3.2%) in the corresponding period of 2009. This result was impacted by an increase in the average tax rate.

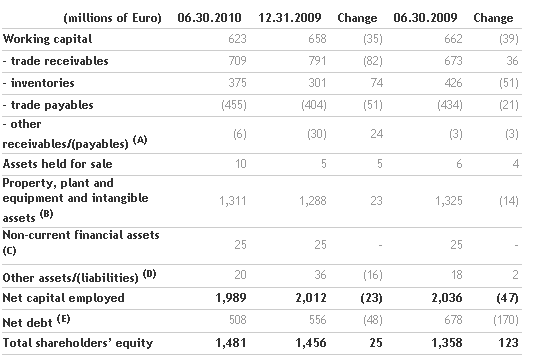

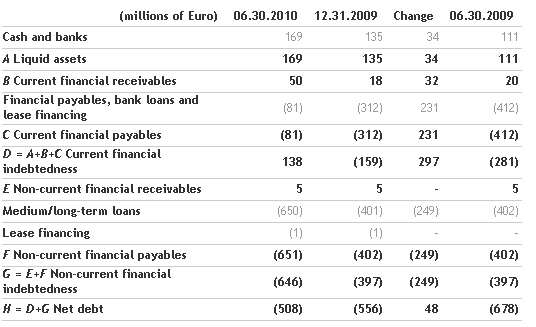

Consolidated financial situation

Compared with December 31, 2009, there was an increase in fixed assets (€23 million) as a result of the investment policy, further detailed below, and a reduction in working capital (€35 million) due to the improved payables/receivables position.

Compared with June 30, 2009, there was a significant reduction in working capital (€39 million), achieved through reduced inventories (€51 million) and higher trade payables (€21 million), in spite of higher receivables.

Net financial indebtedness at June 30, 2010 was €508 million, down by €48 million compared with December 31, 2009, underlining the strong cash generation in the first half year.

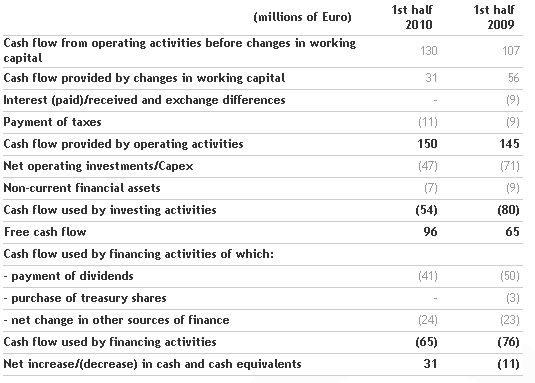

Summary of consolidated cash flows

Cash flow generated by operating activities totalled €150 million, against €145 million in the comparative period.

In the first half of 2010, the Group made net investments of €54 million. To be noted, were €44 million of commercial and real estate investments and €6 million of investment in industrial activities.

Outlook for the year

The cost reduction actions, introduced last year, are having the desired effects and the general level of efficiency in the production area, together with the strength of the brands and the capillary sales network are supporting the strong improvement in results achieved in the first half year.

The 2nd half of 2010 will see, among other things, significant commercial investments, with the relaunch and creation of innovative spaces in the larger Flagship Stores, in cooperation with famous architects and the acquisition of strategic locations in emerging markets.

All company efforts are therefore focussed on creating the right conditions for the resumption of growth, also with the support offered to the Asian markets, accompanied by an unchanged and continuing commitment to greater efficiency.

However, new orders taken for the Fall/Winter collection demonstrate continuing weakness in the economies of markets historically of greater relevance to the Group.

Expected trends in the second part of 2010 confirm estimates for the current full year of a slight reduction in operating margins compared with 2009 levels, in the presence of significant non-recurring costs of an amount similar to the previous year, a greater cost of borrowing due to the loan arranged in June to replace the expired loan and, as already mentioned, a slight increase in the average tax rate.

Benetton Group consolidated results

Consolidated statement of income

(*) Trading profit was 75 million, representing 8.5% of revenues (54 million in first half 2009, representing 6.1% of revenues, and 229 million in 2009 representing 11.1% of revenues).

Balance sheet and financial position highlights

(A) Other receivables/(payables) include VAT receivables and payables, sundry receivables and payables, non-trade receivables and payables from/to Group companies, accruals and deferrals, payables to social security institutions and employees, receivables and payables for fixed asset purchases etc.

(B) Property, plant and equipment and intangible assets include all categories of assets net of the related accumulated depreciation, amortization, and impairment losses.

(C) Non-current financial assets include unconsolidated investments and guarantee deposits paid and received.

(D) Other assets/(liabilities) include retirement benefit obligations, provisions for legal and tax risks, the provision for sales agent indemnities, other provisions, current tax receivables and liabilities, receivables and payables due from/to holding companies in relation to the group tax election, deferred tax assets also in relation to the company reorganization carried out in 2003, deferred tax liabilities and payables for put options.

(E) Net debt includes cash and cash equivalents and all short and medium/long-term financial assets and liabilities.

Financial position

Cash flow statement

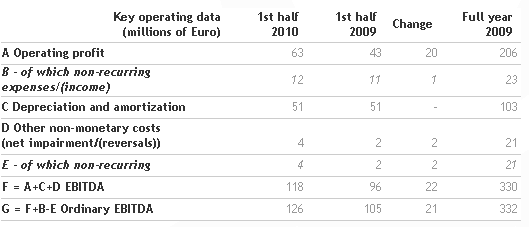

Alternative performance indicators

In addition to the standard financial indicators required by IFRS, this press release also contains a number of alternative performance indicators for the purposes of allowing a better appreciation of the Group's financial and economic results. These indicators must not, however, be treated as replacing the standard ones required by IFRS.

The following table shows how EBITDA and ordinary EBITDA are made up.

Declaration by the manager responsible for preparing the company's financial reports

The manager responsible for preparing the company's financial reports, Alberto Nathansohn, declares, pursuant to paragraph 2 of Article 154-bis of the Consolidated Law on Finance, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Disclaimer

This document contains forward-looking statements relating to future events and operating, economic and financial results of the Benetton Group. By their nature such forecasts contain an element of risk and uncertainty because they depend on the occurrence of future events and developments. The actual results may differ, even significantly, from those announced for a number of reasons.

For further information:

Media

+39 0422 519036

press.benettongroup.com

benettonpress.mobi

Investor Relations

+39 0422 517773

investors.benettongroup.com

benettonir.mobi